EMI Full Form is Equated Monthly Installment. It is a fixed Amount, pay by us to the Bank every month within a specified time frame. Whenever you take a loan from bank for buying anything, then a time limit is given to you for paying that loan. You have to repay that loan within that time limit. Amount of EMI would be based on the amount of loan.

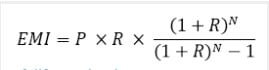

How To Calculate EMI

1. Loan Amount – What is the Amount of the loan you have taken? Suppose Loan Amount = Rs. 100000.

2 . Duration – What is the time limit for repaying that loan. Suppose it is for 30 months.

3. Interest Rate – Interest rate is 1 percent per month.

Advantages Of EMI

- Power to Buy: It enables you buy items beyond your monetary reach by allowing you pay in installments.

- Flexibility: You can consider different EMI options offered by different banks and decide the amount that you want to pay as installments and can also choose the tenure of loan as per your financial position.

- No middleman: You directly pay the EMI to the lender without the hassle of contacting a middleman.

- Protects Savings: It does not hurt your savings as you are required to pay minimum regular payments instead of a lump sum amount.

Leave a Comment