Meaning – The auditor is appointed to verify the accounts of an organisation. After verifying the accounts the auditor gives a brief description of the work done by him, which is signed by him. This description is known as the audit report.

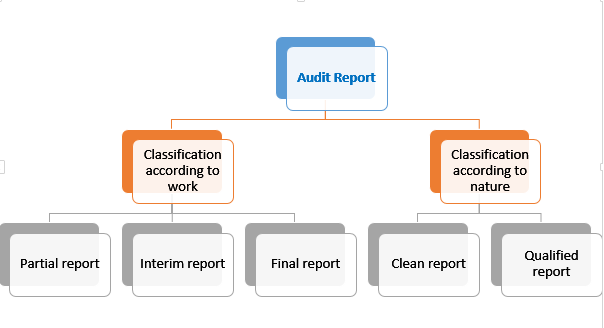

Types Of Audit Report

Classification according to work

(1) Partial Report: If the auditor is not appointed to verify all the accounts, but only some books of accounts and the auditor issues a report, then, it is known as Partial Report’. While writing this report the auditor should keep in mind that a person reading the report should not take it as a full report. Therefore in such kind of a report the auditor should make it clear that he has been appointed for a partial verification and the report is a partial report. If the auditor does not specify the fact that it is a partial report he will be held guilty of negligence.

(2) Interim Report: When an auditor issues a report in the middle of the year on certain special issues then such a report is known as an ‘Interim Report’. Normally such a report is presented on declaring interim dividend or when the central government issues an order.

(3) Final Report: When the auditor issues a report after the completion of the audit for the entire business year then such a report is known as a Final Report’. Normally an auditor issues such a report only. This report plays an important part in the life of a company. Therefore special care should be exercised in framing this report.

Classification according to nature

(1) Clean Report: If the auditor after verifying the books of accounts comes to the conclusions that the books of accounts have been appropriately maintained, there are no mistakes, inadequacies and frauds, the profit or loss as shown by the profit and loss account and the financial position as per the Balance Sheet are correct which means that the auditor has no complaints or suspicions, then in such a situation the report issued by him is called a clean report. It is also known as an unqualified report.

(2) Qualified Report: If during the audit the auditor finds any discrepancies, irregularities frauds or other deficiency in the books of accounts, i.e., he is not fully satisfied about the accuracy of the Profit and Loss Account and Balance Sheet of the organisation then he should write in his report the various points which make the accounts of the organisation inaccurate.

Leave a Comment