Strategic choice or strategic decision is the process of systematically comparing the impact of the possible strategies on product-market and the firm. Selection strategy is a careful conscious deliberate and creative activity. It involves trade offs between different courses of action. Professor Henry Mintzberg says “Strategy formulation is interplay among three basic forces –

- a dynamic environment that changes continuously but irregularly with frequent discontinuities and wide swings in the rate of change;

- the operating system of the organisation which seeks to stabilise its activities despite the characteristics of the environment it serves; and

- the role of leadership mediating between two forces so as to maintain stability of the organisation, operating system while at the same time adapting it to the environmental change.

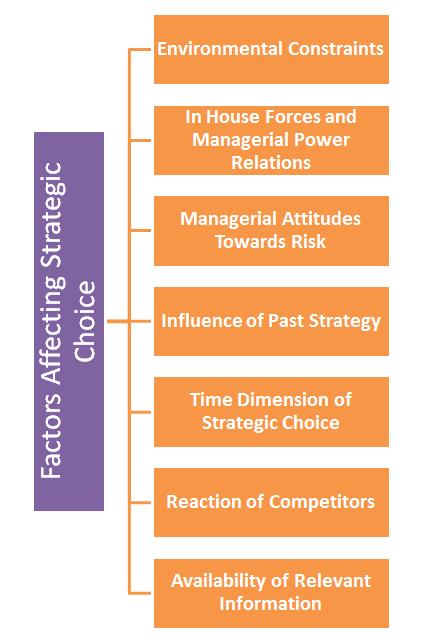

Factors Affecting Strategic Choice

(1) Environmental Constraints – The very survival and growth and hence, prosperity of a unit rest on its exposure to and interaction with its environment which is external. External environment is made up of its publics namely shareholders, suppliers, competitors, customers, lenders, government and the community. These elements are the external constraints. The flexibility in the choice of a strategy, is governed by the extent of the firm’s dependence on the these elements and the extent to which these constraints cooperate. Comparatively, those organisations which are well settled, deep rooted and large in industries are much more powerful as against their counter part namely, the environment. They enjoy greater flexibility and lee way in strategic choice.

For example, a company which gets bulk supply of inputs raw-material and component parts in a highly sensitive market has greater degree of flexibility in strategic choice as compared to the company which depends for its inputs on a market which is monopolistic. The strategies of competitors in any area of business will have impact on choice of a strategy. What financial or production or marketing, or personnel strategies the firm is to follow will depend on what competitors are doing. A shareholder holding majority of shares, has say in strategy the company is to formulate because his preferences can not be ignored. Customers are the real decision makers whose likes and dislikes can not be thrown to winds. Changing governmental policies will have to be respected. Again, it is community in which company is working decides what company should do and should not do.

(2) In House Forces and Managerial Power Relations – The in house forces play a significant role. Let us confine to only decision making process. In a highly controlled or centralised company, it is the top management which has the total power to configure the strategic choice. That is, the decision-strategic decision-made is by centralised management, is quick and not diluted.

Another very important variable is that of managerial power relations. It is normally found that the major decisions are influenced by the power play among interest groups that differ widely. Even the strategic choice is influenced by this variable. In case a influencing chief executive is in favour of a strategic choice which also benefits other top management members, it may be endorsed easily by other senior member. This happens when unity prevails. However, this can be opposed in case there is power politics or power game as we find in Indian Parliamentary Affairs.

(3) Managerial Attitudes Towards Risk – Managerial attitudes towards risk is yet another significant factor that affects the choice of a strategy. The managerial decision is guided by the attitude of the decision- maker towards risk. Based on this “attitude towards risk” decision-makers can be of three types namely, Risk lover, Risk Averse and Risk neutral. Then one may distinguish between the following attitudes reflecting the order of risk preferences.

- Risk is necessary for success

- Risk is a fact of life and some risk is desirable and

- High risk destroys enterprises and needs to be minimised as given by Professor William F.Glueck.

By nature executives who are risk lovers go in for high returns, high growth, less stable markets as there is direct relationship between risk and the reward. These people prefer to be pioneers, innovators, early birds.

On the other hand, the risk averse or people who want to take least risks are those who want to be followers than leaders and challengers, they prefer stable conditions, low returns and go in for safer options.

Age factor also plays decisive role. The old managers tend to take no extra risk unlike young people who are yet to make mark. Those who deal with risk and uncertainty easily are able to face successfully the complex problems than those who are risk averse. Risk prone decision makers limit the amount of information and make decisions quickly as if it is an impulsive task.

(4) Influence of Past Strategy – Future has its roots in the past. To this, past strategy is no exception. That is, choice of the current and the future is influenced by the past strategy due to number of reasons. The foundation for formulation of new strategies is the past strategy. In the light of the past strategy, the strategist either might not have thought of altering it or it is also possible that the strategists might have taken the things lightly and might not have thought of alternatives with the seriousness that they deserve due to intertia. Personal involvement of the decision maker with the past strategy will continue to do so. Thus, the present and future strategies will be influenced by personal involvement.

(5) Time Dimension of Strategic Choice – Yet another very important factor in the process of strategic decision making is the time dimension of strategic choice. This time dimension has four elements which one can not ignore, these are-time pressure, time frame, time horizon and timing of the decision.

- Time Pressure

- Time Frame

- Time Horizon

- Timing of Decision

(6) Reaction of Competitors – The strategic choice of a strategy option is bound to reflex in the competitors’ reaction. Therefore, a wise strategist places himself in the shoes of the competitor or competitors to know where exactly the shoe bites. Only after studying the reactions, he may be able to take correct decision than ignoring the impact of competitor reaction. Much depends on your market position. That is, whether you are leader, challenger, follower or nicher. Say, both your firm and your arch-rival firm are challengers. In this case, it is quite possible that your competitor may take your strategic option as very aggressive and makes the competitor to have counter strategy to over power you.

Say, you reduced the price of your branded product, then other company might reduce equally and give some addition incentive in kind. If you are a followers, then the strategy of follow the suit operates. We know the case of price war going on between arch rivals namely Hindustan Lever and Proctor and Gamble. If the first company has reduced the price of Surf Excel from 85 to 70 for a half kilo pack, Proctor and Gamble has done so in case of Arial. Later, Surf Excel has been introduced with new proposition.” The followers say Nirma and others being followers, have no choice than to follow the suit without option. Thus, the competitors reaction has far reaching impact on the choice of a strategy.

(7) Availability of Relevant Information – When it is a question of choice rather rational choice, the quality and quantity of information decide the strategy choice. The choice or strategic decision that is based on facts, the considered opinions other sources of information written as oral are more sound and acceptable that is, the degree of risk and uncertainty depends on the amount and quality of information made available to the decision makers.

There is inverse relationship between the available information and the degree of accuracy of strategic choice. That is, the greater the amount of high quality information, lesser the risk and uncertainty. The decision maker is a risk-prone or a risk averter or risk neutral. Risk prone and risk averters need the information to decide whether to take or not the calculated risks which are unavoidable in the world of business. Hence, the decision makers need a package of relevant information to analyse and interpret and act. The information is not easily available which costs in terms of treasure, time and talent.

Process of Strategic Choice

(1) Focusing on alternatives – The aim of this step is to narrow down the choice to a manageable number of feasible strategies. It can be done by visualizing a future state and working backwards from it. Managers generally use GAP analysis for this purpose. By reverting to business definition it helps the managers to think in a structured manner along any one or more dimensions of the business.

- At Corporate level strategic alternatives are -Expansion, Stability, Retrenchment, Combination

- At Business level strategic alternatives are – Cost leadership, Differentiation or Focused business strategy.

(2) Analyzing the strategic alternatives – The alternatives have to be subjected to a thorough analysis which rely on certain factors known as selection factors. These selection factors determine the criteria on the basis of which the evaluation will take place. They are –

- Objective factors – These are based on analytical techniques and are hard facts used to facilitate strategic choice.

- Subjective factors – These are based on one’s personal judgment, collective or descriptive factors.

(3) Evaluation of strategies – Each factor is evaluated for its capability to help the organization to achieve its objectives. This step involves bringing together analysis carried out on the basis of subjective and objective factors. Successive iterative steps of analyzing different alternatives lie at the heart of such evaluation.

(4) Making a strategic choice – A strategic choice must lead to a clear assessment of alternative which is the most suitable alternative under the existing conditions. A blueprint has to be made that will describe the strategies and conditions under which it operates. Contingency strategies must be also devised.

Leave a Comment